Announcements

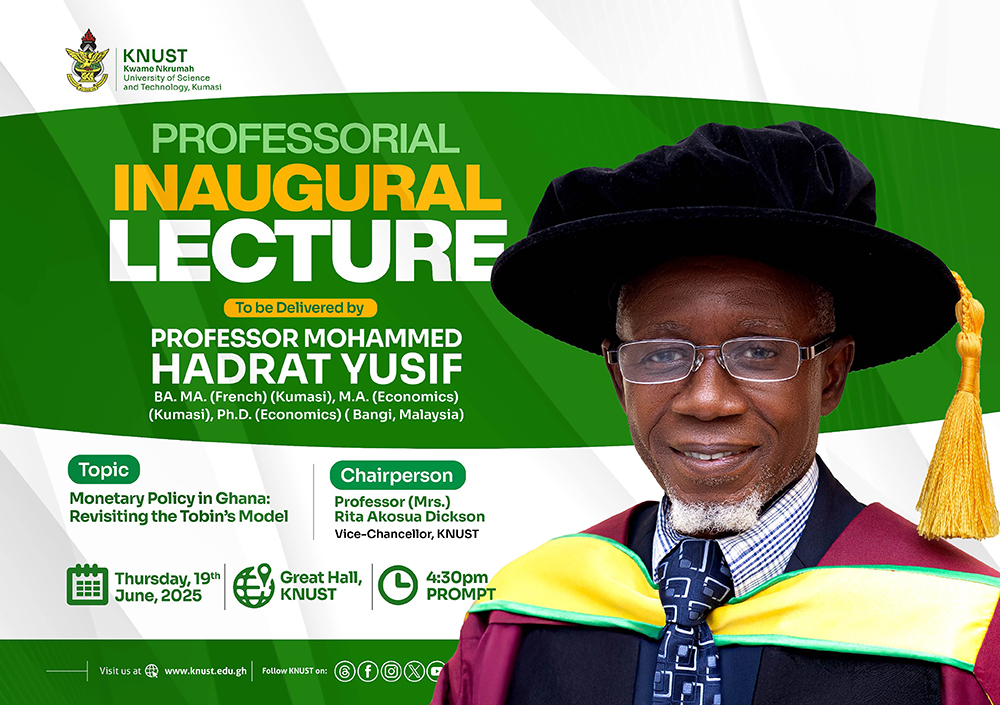

Professorial Inaugural Lecture of Professor Mohammed Hadrat Yusif

The Vice-Chancellor of the Kwame Nkrumah University of Science and Technology (KNUST), Kumasi, through the Public Lectures Committee invites the academic community and the general public to a Professorial Inaugural Lecture to be delivered by: Professor Mohammed Hadrat Yusif as scheduled below:

Abstract of the Lecture

Topic: Monetary Policy in Ghana: Revisiting the Tobin’s Model

Preceding independence in Ghana, policy makers argued that a central bank was one institution which would give true meaning to political independence. Therefore, two days before independence, 4th March, 1957, the Bank of Ghana (BoG) was formally established by the Bank of Ghana Ordinance (No. 34) of 1957, passed by the British Parliament.

The BoG is responsible for monetary policy in Ghana, with the primary objective of stabilizing the value of the cedi within and outside Ghana, control money supply and set interest rates in order to create an enabling environment for sustainable economic growth in the country. By performing these functions, the BoG is expected to take centre stage in the growth and development of Ghana through several channels, including inflation, interest rates, exchange rates, consumption, government spending, investment, employment, and the general level of economic activities.

Dr. Kwame Nkrumah became the first Prime Minister of Ghana in 1957, and his government's development ambitions were motivated by two key factors. Firstly, increase agricultural productivity through large-scale mechanised farming, with the Government directly investing in state farms and cooperatives. Secondly, transform Ghana from primary commodity-producing country into an industrialized economy. However, these investments had limited impact on per capita GDP growth due to misguided investment decisions, mismanagement, and the inflationary effect of import restrictions, among other factors. Indeed, positive real economic growth was not sustained for long period, GDP growth rate declined from 13.3% in 1959, 4.11% in 1962 to 1.37% in 1965 and -4.26% in 1966. In 2020, growth rate was 0.5% and increased to 2.94% in 2024.

From 1960 to 2024, there has been unregulated government borrowing from both domestic and external sources. Successive governments have pressured the BoG to print more money, sell government bonds and securities to financial institutions (commercial banks, savings banks, trust funds, pensions funds, local bodies, business firms, etc.), and individuals, borrowing from abroad (foreign governments, IMF and other international agencies). Ghana’s domestic debt (external debt) as percent of GDP increased from 35% (20%) in 2016 to 70% (30%) in 2020 and to 90% (50%) in 2024.

Indeed, Ghana has accumulated significant debt, becoming one of Africa’s most indebted countries together with Chad, Sudan, Somalia, Zambia, Mozambique, Tunisia, Kenya). Yet, we lack the basic socio-economic infrastructure required for development (safe roads, safe drinking water, hospitals, good schools, etc). Production of export crops and food crops declining and manufacturing also declining.

We find ourselves in the shadow of daunting longer-term challenges to economic growth and shared prosperity in Ghana. Indeed, the initial goal of the BoG to stabilize domestic prices, stabilize the exchange rates, set interest rates, and control money supply, thereby creating the enabling environment for economic growth in Ghana, has not been effectively and sustainably achieved.

In today’s world, marked by declining development aid, global tariff wars impacting trade and foreign exchange, restrictive immigration policies affecting remittances, negative perception about Ghana and sub-Sahara African countries affecting investor confidence; Ghana can no longer rely on the developed countries for sustained growth and development. Ghana must look within to raise the needed financial resources, and the BoG can also play a role as raised in the Tobin’s Portfolio Balance Approach to money model. Indeed, in monetary policy, there are two key principles or schools of thought:

- Classical economics, (advocating limited government intervention in the economy and also neutrality and superneutrality of money supply).

- Keynesian economics (advocates for government intervention to stabilize the economy and non-neutrality of money).

Tobin’s model is an extension of Keyes Liquidity Preference theory and concludes that an increase in monetary expansion can lead to decline in interest rate, making borrowing cheaper, investment in real capital assets increase which could lead to higher growth.

Using BoG and World Bank Development indicators’ data, we run three separate set of regressions; first with inflation as depended variable, to establish the effect of money supply on inflation. In the second set of regressions, we proxied broad money growth by the natural log of M2+ to investigate the effect of money supply on economic growth. For the third set of regressions, we also examined the effect of money supply on economic growth using BoG classification of money supply, M1, M2 and M2+. There was no evidence to reject the relevance of Tobin’s Portfolio Choice Model in our current developmental challenges.

The lecture will advance policy recommendations including:

- Review of the existing Fiscal Responsibility Act, 2018, (Act 982) by Ghana Parliament that charges government to maintain an overall fiscal balance on a cash basis with deficit not exceeding 5% of the GDP for a particular year.

- Review of the Bank of Ghana Act, 2002 (Act 612, 30) which specifies that, total of the loan advances, purchase of Treasury Bills, and Securities with money borrowed by the government from other banking institutions and the public at the close of a financial year shall not exceed 10% of the total revenue of the fiscal year in which the advances were made.

Realistic debt targets aligned with Government of Ghana economic development goals could be set. Indeed, limiting the scope for government to very narrow limits of 5% of GDP has not forced the government to pursue prudent fiscal discipline in order to avoid debt trap. I will recommend the Norway and Sweden model of ensuring transparency and accountability in government financing, as well as expenditure and debt management.

Finally, the lecture will advance policy recommendations for the future to ensure monetary policy is a potent tool for macroeconomic stabilization in Ghana. These will include:

- BoG considering shifting from Inflation Targeting to Nominal GDP Targeting as rule for Monetary Policy. Nominal GDP targeting involves setting target for growth rate of nominal GDP (sum of inflation and real GDP growth). If financial discipline is pursued rigorously, it will help increase real GDP growth, stabilize labour market and also the financial system.

- Paradigm shift to investing in domestic wealth building and gradually shift economic power to Ghana and in this fiscal policy is key. Thus, we need to build wealth from local assets instead of importing wealth. Reforms to improve productivity and create market is essential for increasing potential growth in a sustained way.

- BoG to collaborate with universities and other relevant research institutions in Ghana and develop a creative programme of research aimed at making monetary policy effective and efficient in the country.

Keywords: Inaugural lecture, Bank of Ghana, money supply, monetary policy, inflation, inflation targeting, economic growth, Tobin’s model

Profile of Professor Mohammed Hadrat Yusif

B.A. Social Sciences (Econ & French) (Kumasi), M.A. (Comparative Lit. French Option) (Kumasi), M.A. Economics (Kumasi), Ph.D. (Economics) ( Bangi, Malaysia).

Background

Hadrat Mohammed Yusif is a Professor of Economics at the Department of Economics, Faculty of Social Sciences, College of Humanities and Social Sciences, Kwame Nkrumah University of Science and Technology, Kumasi, (KNUST). He was Head of the Department of Economics, for the periods, 2022-2024 and 2015-2017. He served as Vice Dean for the Faculty of Social Sciences from 2016 to 2018 and the College Examinations Officer, College of Humanities and Social Sciences, from 2018 to 2022.

Prof. Yusif has expertise in both the economics of education and monetary policy. However, his research focus shifted from economics of education to monetary policy due to abject poverty, youth unemployment, poor road infrastructure, poor health facilities, undrinkable water in some communities, declining agricultural production, declining industrial production, and general economic hardship. He has published in high impact journals including African Development Review, Development Policy Review, Journal of International Development, Higher Education, and Review of Education.

Prof. Yusif is the son of Salifu Samani Sioni and Alimatu Yemboni, all of blessed memory. He was born at Ohwim, near Kumasi, in the Ashanti Region but was shortly sent to Ayomso in the Ahafo Region where he spent some years. The family later moved back to Kumasi and settled at Moshie Zongo. His hometown is Yarigungo, near Bawku in the Upper East Region. During his school days at Moshie Zongo, he assisted his father on the sugar cane farm. Prof Yusif is married and has six children.

Educational Attainment

Prof. Yusif started his primary education at Ayomso Methodist Primary, Ayomso, in the Ahafo Region at an early age and continued at New Bantama L/A Primary, Abrepo Junction, Bantama, Kumasi, where he sat for the Common Entrance Examination at Primary Six in 1975. Hadrat was admitted to Kumasi High School where he did the General Certificate of Education (GCE) Ordinary Level (1975-1980) and the GCE Advanced Level (1980-1982) examinations. In 1982, he gained admission to the Kwame Nkrumah University of Science and Technology, Kumasi. However, universities in Ghana were closed for one academic year. When they were reopened, he returned to continue his education at KNUST in 1983.

He offered double major, Economics and French, so benefitted from the One Year French Abroad programme at the Université du Benin (UB) in Togo. He finally obtained the B.A. (Hon.) Social Sciences (Economics and French) degree in 1987. After the National Service Prof. Yusif enrolled for the MA Comparative Literature, French Option at the then Department of Languages (now Department of Languages and Communication Sciences), KNUST in 1990 and successfully graduated in 1993. He was a Graduate Assistant at the Department during this period. In 1993, he joined Osei Kyeretwie Secondary School where he taught Economics and French. In 2000, he earned MA. Economics from KNUST.

Prof. Yusif obtained GETFUND scholarship in 2007 to pursue PhD in Economics at the National University of Malaysia, (Universiti Kebangsaan Malaysia, UKM) Bangi, Selangor, Malaysia, and successfully completed in 2011.

Teaching and Administrative Experience

Prof Yusif started teaching at Osei Kyeretwie Senior High School in 1988, where he taught both GCE Ordinary Level and GCE Advanced Level students in both Economics and French. Hadrat demonstrates strong analytical and communication skills. From 1990 to 1993, he served as a Graduate Assistant at the Department of Languages; Demonstrator, Department of Economics from 1999 to 2002; Lecturer, Department of Economics, KNUST, from 2002 to 2012. Whilst doing his PhD in Malaysia, he was a Graduate Assistant at Faculty of Economics and Business, National University of Malaysia, Bangi, Selangor, Malaysia in 2008. He also taught Research Methods at Legenda College, Negeri Sembilan, Malaysia in 2009. After completing his PhD, he returned to KNUST and was promoted to Senior lecturer in 2012, Associate Professor in 2018, and Professor in 2022.

Indeed, for over thirty years, he has been teaching and has produced quality graduates occupying very important and critical positions in KNUST, Ghana and the international community. These are few notable ones: Professor Charles Marfo, Provost, College of Humanities and Social Sciences, KNUST, Professor K.O. Appiah, Head, Department of Accounting and Finance, KSB, KNUST, Professor Daniel Sakyi, Director, Centre for Cultural and African Studies (CeCASt), KNUST, Professor Henry K. Mensah, Head, Department of Human Resource Management, KSB, KNUST; Professor Abdul-Samed Muntaka, Department of Logistics and Supply Chain Management, KNUST and also past and present Council Member, KNUST; Dr. Daniel Domeher, Department of Accounting and Finance, KSB, KNUST; Dr. Samuel Tawiah Baidoo, Department of Economics, KNUST, Dr. Elliot Boateng, Department of Economics, KNUST; Effah Sarkodie, Head, Department of Economics, Akenten Appiah-Menka University of Skills Training and Entrepreneurial Development, Kumasi. Business mogul, Stephen Boateng, Esq., popularly known as KESSBEN; Dr. Jennifer Frimpong, Canada Revenue Authority (CRA), Manitoba, Canada. Professor Paul Alagidede; the Hon. Minister of Finance and Member of Parliament for Ajumako Enyan Esiam Constituency, Dr. Cassiel Ato Forson. Undoubtedly, Prof. Yusif through his quality teaching has contributed to the improvement of quality of life for Ghanaians and non-Ghanaians, thus has contributed immensely to the fulfilment of the KNUST’s mission of improving quality of life.

Prof. Yusif has significant administrative experience. He was Head of the Department of Economics, KNUST for two periods, 2015-2017 and 2022-2024; Vice-Dean, Faculty of Social Sciences, KNUST, 2016 - 2018. For his reliability, he has occupied very high and critical positions in KNUST including, College Examinations Officer, College of Humanities and Social Sciences, August, 2018 - August, 2024; Department Examinations Officer, Department of Economics, KNUST, September, 2011 - July, 2015, and also October, 2005 - 2006.

Prof. Yusif has also occupied high-profile positions on boards and committees at KNUST, Kumasi, including; Chairman of the Quality Assurance Sub-Committee in the College of Humanities and Social Sciences, KNUST, October, 2016 - July, 2020 and Chairman of the KNUST Senior Staff Housing Committee March, 2023 - 2025. Others are Representative of College of Humanities and Social Sciences (CoHSS), International Programme Office (IPO) Board; November, 2015 - July, 2020. Member of the Committee to self-evaluate KNUST for institutional accreditation, member of the Committee to Develop an Instrument for the Auditing of Affiliate Private University Colleges, KNUST’s Academic Board and Appointment and Promotions Representative at Ratford University College, KNUST Affiliate from August, 2018 to July, 2020. KNUST’s Academic Board and Appointment and Promotions Representative Fountainhead Christian College for two successive periods, from August, 2022 to July, 2024 and from August, 2024 to July, 2026.

Postgraduate Research Supervision

Prof. Yusif has supervised and graduated over 550 MA, MSc, MBA and MPhil students in KNUST and also at the University of Education Winneba, Kumasi. Professor Yusif, together with his supervision team, has graduated five PhD candidates in KNUST and University of Education Winneba. All the PhD students and some of the MPhil students are academic senior members in public universities in Ghana.

Service to Other Universities and Organizations

Since joining KNUST in February 2002, Prof. Yusif has served many universities in Ghana and the rest of Africa in his capacity as visiting lecturer, postgraduate supervisor, moderator, external examiner and assessor for promotion. Notable ones are the University of Cape Coast, University of Education Winneba, Winneba; The University for Development Studies, Tamale, C. K. Tedam University of Technology & Applied Sciences, SD Dombo University of Business & Integrated Development Studies, Accra Technical University, Ho Technical University, Bolgatanga Technical University, The Sunyani Technical University, University of Energy and Natural Resources, Sunyani, Garden City University College, Kenyase, the University of South Africa, and the Nelson Mandela University, South Africa. Given his expertise he has served the West Africa Examinations Council in various capacities for over a decade, specifically in the economics subject area.

Academic, Consulting and Mentorship Activities

Prof. Yusif has been involved in the design and teaching of undergraduate and postgraduate courses for regular programmes at the Department of Economics, KNUST and also for programmes mounted at the Institute of Distance Learning, (IDL), KNUST, platform. These include MSc. Economics, MSc Economics and Finance, and MSc Business Economics, MPhil Economics and PhD Economics. For the periods that he was Head of the Department of Economics, KNUST, he played key role in developing research capacity on monetary policy, financial inclusion, demand for money, among others.

Prof. Yusif was the lead economist in the TCC, KNUST team drawn from three Colleges in KNUST that undertook value chain study for the Rural Enterprises Project (REP) in May, 2020. He has provided training for Heads of Business Advisory Centres (BACs) under the Japan International Co-operation Agency (JICA) and National Board for Small Scale Industries (NBSSI) dubbed Workshops on Business Development Service (BDS). Together with his team he has worked with the African Development Bank, providing translation services. In 2016, he contributed significantly to the Ministry of Finance, stakeholder consultative workshop on revised Draft Local Government Borrowing Bill at Alisa Hotel in Accra.

Scholarly Contribution to Research in Ghana and Africa

During his 23 years at the Department of Economics, KNUST, Prof. Yusif has undertaken scholarly research highlighting the economic problems in Africa and Ghana in particular. His research has been interdisciplinary but focusing more on monetary economics. He has published on a wide range of topics, predominantly on monetary economics. He has over sixty publications published in top scholarly journals. Given his interest and career goals, Prof. Yusif’s major themes have been not only on financial inclusion, monetary policy and growth but also on education (university admissions, academic performance, less endowed students in Ghana, and policy on university education in Ghana). His research has been impactful and has been cited in reputable academic journals and also used as teaching materials by academicians.

Future Research Plans

In future, Prof. Yusif intends to work on uncertainty and economic growth in sub-Sahara Africa (SSA). Use both quantitative and qualitative techniques to quantifying uncertainty in long-run sustainable growth and also productivity growth in the region. This will be challenging task due to climate and environmental damage, corruption, institutional weaknesses, and resource constraints. However, just as in the industrialized economies, understanding uncertainties is key to making informed regulatory decisions that can propel growth in SSA. Promoting effective and efficient monetary and fiscal policies for sustainable growth and development.